Recent Volatility in the Markets

The recent volatility in the markets has created a lot of questions and concerns for investors. In the past few days, we have had swings that went from steep losses to recovering by the end of day for the major indices. The markets are pricing in the Federal Reserve’s decision to start tightening monetary policy and raise rates. In addition, they are pricing in the geopolitical news, lingering concerns surrounding the virus and concerns over inflation. The end of day bounce back reflected a market that was generally oversold and investors stepping back in to buy. Some investors’ view this as a buying opportunity.

While we recognize that market volatility is difficult to handle, it’s important to recognize that emotional investing will only hurt in the log run. Trying to time the market is extremely difficult and jumping in and out will only lead to possible tax ramifications and losses. On average, stock market corrections such as these happen one to two times every year and it’s important to keep a long-term view. They also often present good opportunities to buy and/or rebalance your portfolio.

Fundamentally the US economy is on positive footing. The supply chain issues show signs of receding and inflation is predicted to be more moderate later in the year. These types of markets are why we emphasize diversification and adherence to your risk tolerance. The last 3 years (2019-2021) provided positive returns that were exceptional and out of the ordinary, despite the pandemic. There are still returns to be had, maybe not the high double digits we saw but being diversified across different sectors will help. If you are an investor that cannot stomach the volatility, it would be prudent to revisit your asset allocations. Long term investing has proven that the stock market is able to continually grow even in the face of adverse conditions. As always, we are available to meet and discuss.

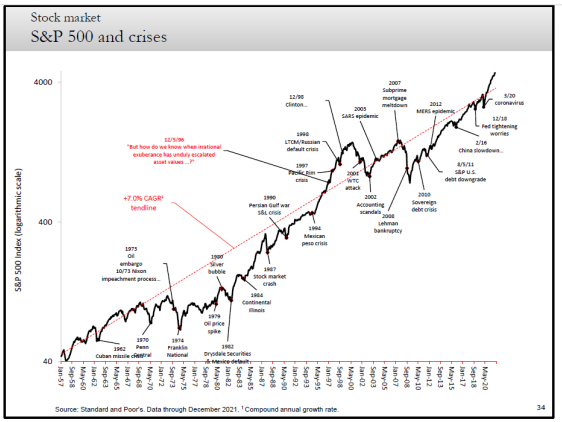

The chart above emphasizes how crises and corrections look like blips on the screen when you take a long-term historical view of the markets.